If debt has ever kept you up at night, you’re not alone. Credit cards, student loans, medical bills—it all adds up fast. And while the internet is full of aggressive “pay-it-off-now!” advice, not everyone can throw thousands at their balances each month. Life still happens. Rent’s due. Groceries aren’t getting cheaper. So how do you make progress without spiraling into panic or deprivation?

Good news: you don’t have to go to extremes to get out of debt. You can crush it without sacrificing your sanity, your social life, or your favorite coffee order (okay, maybe some of them). Here’s how to tackle debt in a way that’s smart, sustainable, and doable.

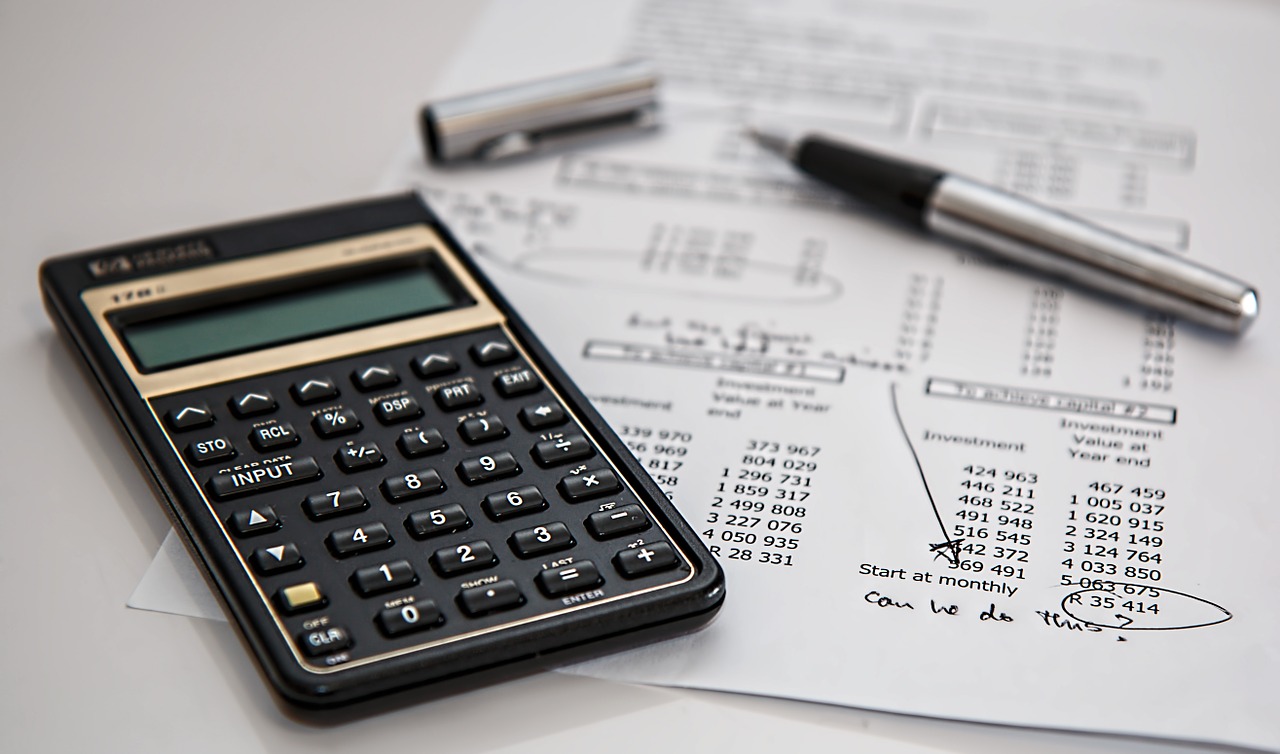

Know Your Numbers (Without the Panic)

The first step is simple, but it’s often the hardest—face the numbers. Total up what you owe, what the interest rates are, and what minimum payments look like. It’s tempting to avoid this part, but knowledge is power. Seeing the full picture can feel scary at first, but it’s also the starting point for taking back control. Once you know where you stand, you can figure out where to go next.

Pick a Strategy That Fits You

There’s no one-size-fits-all solution. Some people thrive on the snowball method (paying off the smallest debts first for momentum), while others save more in interest by tackling high-rate debt first (the avalanche method). Choose a strategy that matches your personality and keeps you motivated. If you need quick wins to stay inspired, go snowball. If you’re numbers-driven and want maximum savings, go avalanche. Either way, progress is progress.

Automate What You Can

One easy sanity-saver? Automation. Set up automatic payments—even just the minimums—to avoid late fees and reduce the mental load of remembering due dates. If you can swing extra payments, automate those too (even $20 a month adds up). Automating removes the temptation to skip or delay payments and keeps your momentum going, even on busy or stressful weeks.

Cut Costs Without Cutting Joy

Cutting back doesn’t mean cutting out everything you love. You don’t have to live off rice and beans or cancel every streaming service to get out of debt. Instead, try identifying a few low-impact swaps—like canceling unused subscriptions or meal-prepping a few nights a week. The goal isn’t to punish yourself, it’s to free up extra money without tanking your quality of life. And yes, you can still have fun while paying off debt—it’s all about balance.

Find Extra Money (Without Burning Out)

Sometimes paying off debt faster just means finding a little extra cash here and there. That might mean picking up a side hustle, selling stuff you don’t use, or doing freelance gigs on weekends. But it doesn’t have to be hustle culture 24/7. Even a few hundred bucks here and there—used strategically—can shave months (or years) off your debt timeline. Focus on what’s doable, not what’s extreme.

You don’t have to sacrifice your peace of mind to pay off debt. With the right mindset, a flexible plan, …

Hiring a professional accounting company can help you to improve your business. The accounting company will professionally present your company.

Hiring a professional accounting company can help you to improve your business. The accounting company will professionally present your company.

The Argument for Public and Private Health Cover

The Argument for Public and Private Health Cover