If debt has ever kept you up at night, you’re not alone. Credit cards, student loans, medical bills—it all adds up fast. And while the internet is full of aggressive “pay-it-off-now!” advice, not everyone can throw thousands at their balances each month. Life still happens. Rent’s due. Groceries aren’t getting cheaper. So how do you make progress without spiraling into panic or deprivation?

Good news: you don’t have to go to extremes to get out of debt. You can crush it without sacrificing your sanity, your social life, or your favorite coffee order (okay, maybe some of them). Here’s how to tackle debt in a way that’s smart, sustainable, and doable.

Know Your Numbers (Without the Panic)

The first step is simple, but it’s often the hardest—face the numbers. Total up what you owe, what the interest rates are, and what minimum payments look like. It’s tempting to avoid this part, but knowledge is power. Seeing the full picture can feel scary at first, but it’s also the starting point for taking back control. Once you know where you stand, you can figure out where to go next.

Pick a Strategy That Fits You

There’s no one-size-fits-all solution. Some people thrive on the snowball method (paying off the smallest debts first for momentum), while others save more in interest by tackling high-rate debt first (the avalanche method). Choose a strategy that matches your personality and keeps you motivated. If you need quick wins to stay inspired, go snowball. If you’re numbers-driven and want maximum savings, go avalanche. Either way, progress is progress.

Automate What You Can

One easy sanity-saver? Automation. Set up automatic payments—even just the minimums—to avoid late fees and reduce the mental load of remembering due dates. If you can swing extra payments, automate those too (even $20 a month adds up). Automating removes the temptation to skip or delay payments and keeps your momentum going, even on busy or stressful weeks.

Cut Costs Without Cutting Joy

Cutting back doesn’t mean cutting out everything you love. You don’t have to live off rice and beans or cancel every streaming service to get out of debt. Instead, try identifying a few low-impact swaps—like canceling unused subscriptions or meal-prepping a few nights a week. The goal isn’t to punish yourself, it’s to free up extra money without tanking your quality of life. And yes, you can still have fun while paying off debt—it’s all about balance.

Find Extra Money (Without Burning Out)

Sometimes paying off debt faster just means finding a little extra cash here and there. That might mean picking up a side hustle, selling stuff you don’t use, or doing freelance gigs on weekends. But it doesn’t have to be hustle culture 24/7. Even a few hundred bucks here and there—used strategically—can shave months (or years) off your debt timeline. Focus on what’s doable, not what’s extreme.

You don’t have to sacrifice your peace of mind to pay off debt. With the right mindset, a flexible plan, …

When it comes to managing your cryptocurrency portfolio, having a tool that can effectively filter through the vast number of coins and tokens available is essential. This is where comprehensive filters come into play. By utilizing these filters, you can narrow down your options and focus on the specific criteria that align with your investment goals.

When it comes to managing your cryptocurrency portfolio, having a tool that can effectively filter through the vast number of coins and tokens available is essential. This is where comprehensive filters come into play. By utilizing these filters, you can narrow down your options and focus on the specific criteria that align with your investment goals.

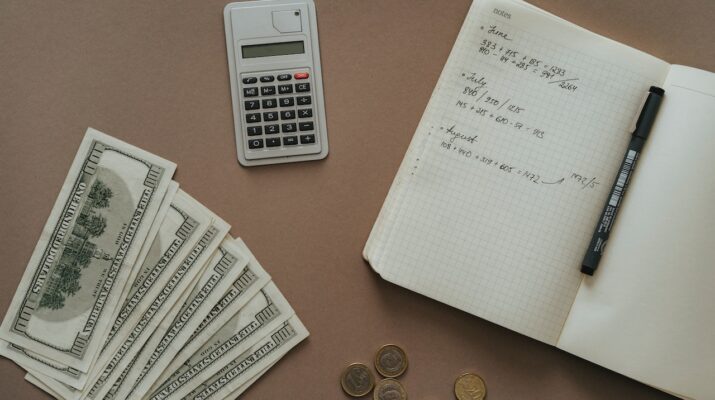

Keeping your finances in order is vital for financial security. When you clearly understand where your money is going and how much you have, it can be easier to plan and ensure that you can cover any unexpected expenses that may arise. Being organized with your finances also helps ensure you don’t get behind on payments and create unnecessary debt. Having a budget and sticking to it is a great way to stay financially secure.

Keeping your finances in order is vital for financial security. When you clearly understand where your money is going and how much you have, it can be easier to plan and ensure that you can cover any unexpected expenses that may arise. Being organized with your finances also helps ensure you don’t get behind on payments and create unnecessary debt. Having a budget and sticking to it is a great way to stay financially secure.

While store credit cards can be tempting, they’re not a good idea if you’re trying to boost your credit score. Store credit cards often have high interest rates and low credit limits, which can lead to debt. It’s best to avoid them altogether. By following these tips, you can boost your credit score in record time. Just make sure you’re patient and consistent with your efforts. It takes time to build up a good credit score, but it’s well worth the effort.…

While store credit cards can be tempting, they’re not a good idea if you’re trying to boost your credit score. Store credit cards often have high interest rates and low credit limits, which can lead to debt. It’s best to avoid them altogether. By following these tips, you can boost your credit score in record time. Just make sure you’re patient and consistent with your efforts. It takes time to build up a good credit score, but it’s well worth the effort.…

By outsourcing accounting operations, you avoid the extra costs. Although in-house staff seems to be less expensive, when you add the costs of supervision, hiring, and training, the total cost increases. Also, you need to pay for their health insurance and other benefits. You can avoid all these by hiring an accounting firm to do the job.

By outsourcing accounting operations, you avoid the extra costs. Although in-house staff seems to be less expensive, when you add the costs of supervision, hiring, and training, the total cost increases. Also, you need to pay for their health insurance and other benefits. You can avoid all these by hiring an accounting firm to do the job. There are times you need advice and guidance on implementing accounting systems. In this case, you can benefit from an experienced accounting company. Remember that you need the latest accounting systems that comply with the law. Also, the systems should help improve the effectiveness and efficiency of your business operations.…

There are times you need advice and guidance on implementing accounting systems. In this case, you can benefit from an experienced accounting company. Remember that you need the latest accounting systems that comply with the law. Also, the systems should help improve the effectiveness and efficiency of your business operations.…

The pandemic has once again shown that a crisis can occur unexpectedly and quickly cover the entire globe. And to feel more confident, especially during periods of instability, you need to follow a few rules.

The pandemic has once again shown that a crisis can occur unexpectedly and quickly cover the entire globe. And to feel more confident, especially during periods of instability, you need to follow a few rules. The size of payments on all debts should not exceed 30% of monthly income so as not to miss payments even in a difficult financial situation. Do not count on a credit or mortgage vacation – there may not be any. In addition, when reducing the Central Bank rate, it is recommended to periodically study the possibilities of refinancing in order to reduce loan payments.

The size of payments on all debts should not exceed 30% of monthly income so as not to miss payments even in a difficult financial situation. Do not count on a credit or mortgage vacation – there may not be any. In addition, when reducing the Central Bank rate, it is recommended to periodically study the possibilities of refinancing in order to reduce loan payments.

There are numerous Recognized Professional Bodies (RPBs) who can license insolvency practitioners. Only licensed practitioners are legally allowed to handle many of the functions required in insolvency proceedings, such as acting as the administrator of a company, liquidator, or supervisors of a voluntary company arrangement.

There are numerous Recognized Professional Bodies (RPBs) who can license insolvency practitioners. Only licensed practitioners are legally allowed to handle many of the functions required in insolvency proceedings, such as acting as the administrator of a company, liquidator, or supervisors of a voluntary company arrangement.

Every person is going through serious financial mess and understands the need for cash flow. This explains why loan application is customized to take a few minutes to complete. A lot of people prefer this type of loan for such reasons. Also, the loans can be utilized for a wide range of reasons and this is why they have become quite popular among the borrowers. Some of the reasons to get these reasons include home improvement, unexpected bills, medical emergencies, and urgent car repairing.

Every person is going through serious financial mess and understands the need for cash flow. This explains why loan application is customized to take a few minutes to complete. A lot of people prefer this type of loan for such reasons. Also, the loans can be utilized for a wide range of reasons and this is why they have become quite popular among the borrowers. Some of the reasons to get these reasons include home improvement, unexpected bills, medical emergencies, and urgent car repairing. In most cases, it is challenging to deal with financial institutions. Also, poor borrowing history can affect your chances of getting a loan. The truth is that your credit score can rule your ability to take loans or you are charged high interest rates. Fortunately, most quick loans do not require your credit report. Moreover, you have the freedom to choose a convenient repayment term.

In most cases, it is challenging to deal with financial institutions. Also, poor borrowing history can affect your chances of getting a loan. The truth is that your credit score can rule your ability to take loans or you are charged high interest rates. Fortunately, most quick loans do not require your credit report. Moreover, you have the freedom to choose a convenient repayment term.

Hiring a professional accounting company can help you to improve your business. The accounting company will professionally present your company.

Hiring a professional accounting company can help you to improve your business. The accounting company will professionally present your company.

The Argument for Public and Private Health Cover

The Argument for Public and Private Health Cover